In this article we will be going over a brand that has had a meteoric rise to fame in recent years and is only one of seven companies in the watch industry estimated to have hit 1B CHF in sales in 2021 – Richard Mille. This is an achievement that simply cannot be understated given the brand was originally founded in 1999 and only released its first watch, the Richard Mille RM001, in 2001. To have accomplished this in just 23 short years is nothing short of remarkable and an industry first. At the heart of the brand is a commitment to innovation, creating watches and new forms of mechanical art that have never been seen or done before in the form of watches that can only be described as racing machines on the wrist. Richard Mille prices in the secondary market now reflect this meteoric rise.

This article is part of our series: Is There a Watch Market Crash? What is Happening to the Secondary Watch Market. In this series, we put the current watch market in context by looking at historical and current pricing from real Luxury Bazaar sales numbers for the top Rolex, Audemars Piguet, Patek Philippe and Richard Mille models.

More from this series:

Rolex Watch Prices: Historical and Current From Actual Sales Numbers

Audemars Piguet Watch Prices: Historical and Current From Actual Sales Numbers

Patek Philippe Watches Prices: Historical and Current From Actual Sales Numbers

Richard Mille Watch Price Fluctuations

Richard Mille watches were not always as wildly popular as they are today. While it now enjoys incredible success, it was not that long ago that Richard Mille prices in the secondary market were pitiful. Watches were sold off in what are known as closeouts – many of which Luxury Bazaar participated in. This entails the brand selling off dead merchandise for pennies on the dollar to watch dealers.

This is why Richard Mille’s story and success are so incredible. To go from a brand that once held closeouts for their watches to selling out of all their watches consistently, having waitlists spanning nearly a decade for certain models, and having so many of their watches sell through grey market watch dealers for many multiples of their retail price is just mind-boggling. What’s even more unbelievable is that while we saw many watch models and brands explode in price and now decline pretty severely in the current market, many Richard Mille prices simply did not experience the decline in the you’d expect considering the explosion they experienced on the secondary market.

Read more: Why Are Richard Mille Watches So Expensive?

The growth in the Richard Mille brand and Richard Mille prices is nothing short of incredible with many becoming some of the most popular and collectible watches on the market today. To show you this growth, we share with you Richard Mille prices, historically to today, based on actual sale prices of four Richard Mille models. We not only showcase that these watches are a great store of value but also a great potential investment vehicle if that is what someone is seeking them to be. And it will inevitably showcase that the current price fluctuation of this brand is not a crash, but rather just a natural cyclical price correction not unlike what other asset markets are currently experiencing.

For a more general overview of current Richard Mille prices across a larger number of models, see What Is The Current Market Price of a Richard Mille Watch?

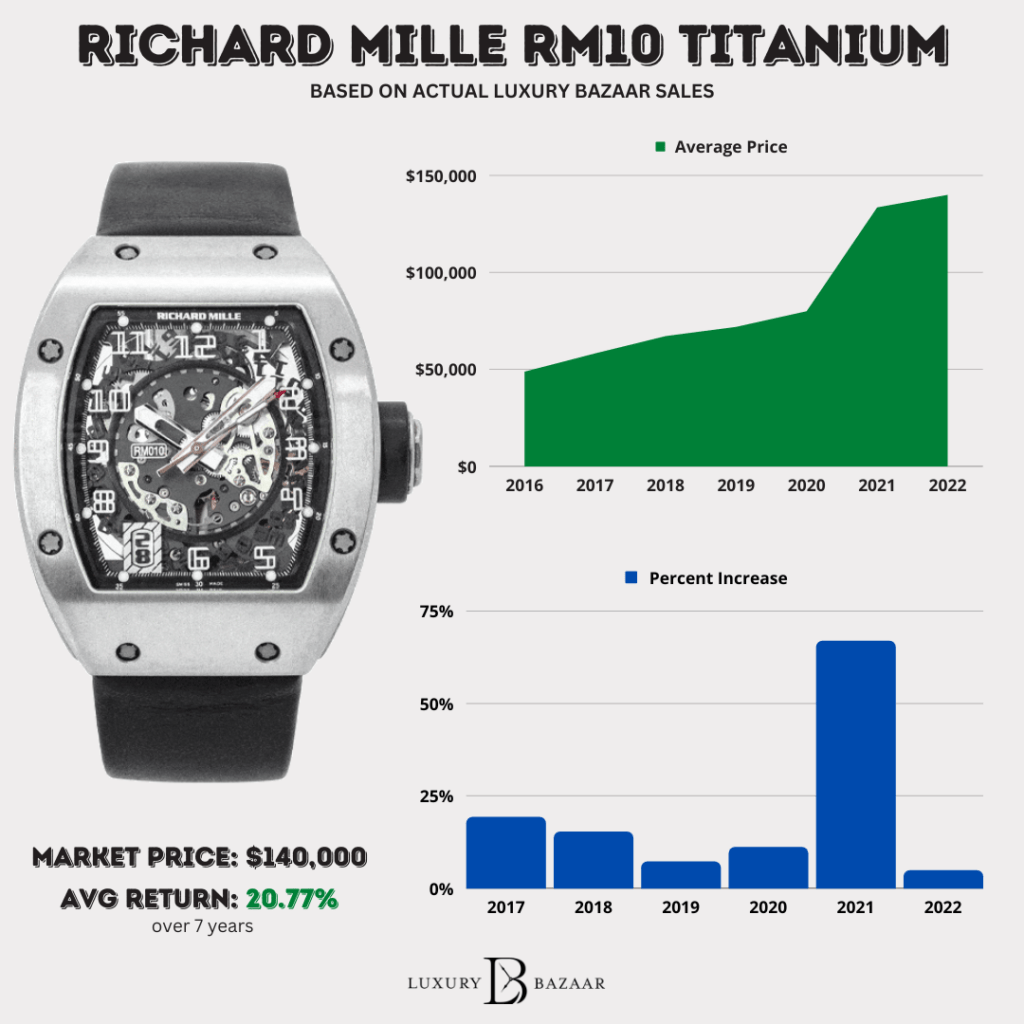

Richard Mille RM10 – Titanium

Launched in 2006, the Richard Mille RM10 was released as a successor to the RM005 with slightly larger case proportions and a dial that was far more skeletonized than its predecessor. The more apparent skeletonization of the movement was also made apparent through this watch’s display caseback where one could admire the movement powering this watch.

The watch features the classic curved tonneau case shape which allows for a great wrist presence and is extremely comfortable as its curved case is extremely ergonomic on the wrist. The watch is incredibly light given its titanium case and has perfect proportions with case dimensions measuring 39mm by 48mm.

In terms of functionality, it is one of Richard Mille’s most basic watches featuring only the time and a date complication at 7 o’clock. This is done deliberately as the RM10 is meant to be an entry level watch for young collectors looking to get a watch from the brand at an accessible price. It also allows the user to really appreciate the simple yet intricate design of the watch through its semi-skeletonized movement.

The movement powering the watch is an automatic movement based on a Vaucher base caliber that is highly modified and customized by Richard Mille with titanium bridges to make the watch ultra-lightweight. The watch features twin barrels to allow for a power reserve of 55 hours and is self-winding with a super complex and innovative variable-geometry rotor made to optimize the rotor’s winding motion. The rotor is built up of several sections and has the ability to adjust on the fly to either speed up the motion of the rotor if one is moving very minimally or slow down the motion of the rotor to protect the movement during high intensity activities. This is really a testament to Richard Mille’s watchmaking which always seeks to go the extra mile and deliver those fine details that really make a difference in a user’s wearing experience. Now discontinued, the RM10 is a fan favorite for collectors looking for an entry into the Richard Mille brand at an attractive price point and through a design which is really appealing.

Historical Price Chart

| Year | Average Price | Percent Increase |

|---|---|---|

| 2016 | $48,833 | – |

| 2017 | $58,250 | 19.28% |

| 2018 | $67,167 | 15.31% |

| 2019 | $72,000 | 7.20% |

| 2020 | $80,000 | 11.11% |

| 2021 | $133,500 | 66.88% |

| 2022 | $140,000 | 4.87% |

In terms of pricing, the RM10 was a watch that traded under its retail price for many years. Again it’s important to put into context the fact that Richard Mille watches simply were not regarded in the same light that they are today. In 2016, the RM10 traded at an average market price of approximately $49,000 which was well below its approximate retail price of $78,000. In 2017, prices of Richard Mille watches really started taking off and this was no exception for the RM10. It achieved an average market price of approximately $58,000, a near 20% increase from the previous year and continued this trend for many more years.

In 2018, the price of the RM10 on the secondary market rose further to an average market price of approximately $67,000 before settling around the $72,000 mark in 2019 and $80,000 in 2020. These two years, 2019 and 2020, were very interesting in the development of Richard Mille pricing on the secondary market overall. This was a time when bitcoin was experiencing slightly more pricing turbulence and this was definitely reflected similarly in the RM market. RM and bitcoin actually trade fairly similarly in terms of trends and patterns where a lot of the RM price explosions on the secondary market coincided with the rise of bitcoin and other crypto currencies. There was also a general feeling during these years of uneasiness regarding RM watches amongst watch collectors who weren’t sure what to make of the RM brand in many cases. Again this was a brand that traded well below its MSRP and even held closeouts not that long ago and now was trading at or in many cases above MSRP.

However, 2021 and the beginning of 2022 were really a game-changer for Richard Mille. This was peak social media hype and you definitely saw that reflected in the price of RM watches overall. In 2021, the RM10 had an average market price of approximately $133,000 and continued to gain in value further in 2022 to an average market price of approximately $140,000. The growth in price of this model is nothing short of remarkable and truly is a testament to how far Richard Mille watches have come, especially considering this is one of their more basic and entry-level watches. The current market price of the Richard Mille RM10 titanium is approximately $140,000.

Investment Return

Despite the overall dip in the market, the Richard Mille RM10 titanium still experienced an average annual return of approximately 21% over 7 years. However, what this graph most importantly showcases is that in any given year, a watch may be subject to price fluctuations, but over time it has a proven track record of steady growth – not unlike that of the stock market. So not only do you get to wear a badass watch that has been spotted on the wrist of some of the biggest celebrities in the world, but also get a watch that has proven to be quite a lucrative alternative asset.

| Case Diameter: | 39mm x 48mm |

| Case Thickness: | 13.1mm |

| Case Metal: | Brushed and Polished Titanium |

| Bracelet Metal: | Alligator Leather |

| Dial: | Skeletonized dial with white gold lume-filled applied hour plots and hour, minute and seconds hands |

| Movement: | RMAS7 ⇒ Modified Vaucher caliber – 32 Jewels |

| Power Reserve: | 55 hours |

| Complications: | Hours, minutes, second, date |

| Price: | $78,000 |

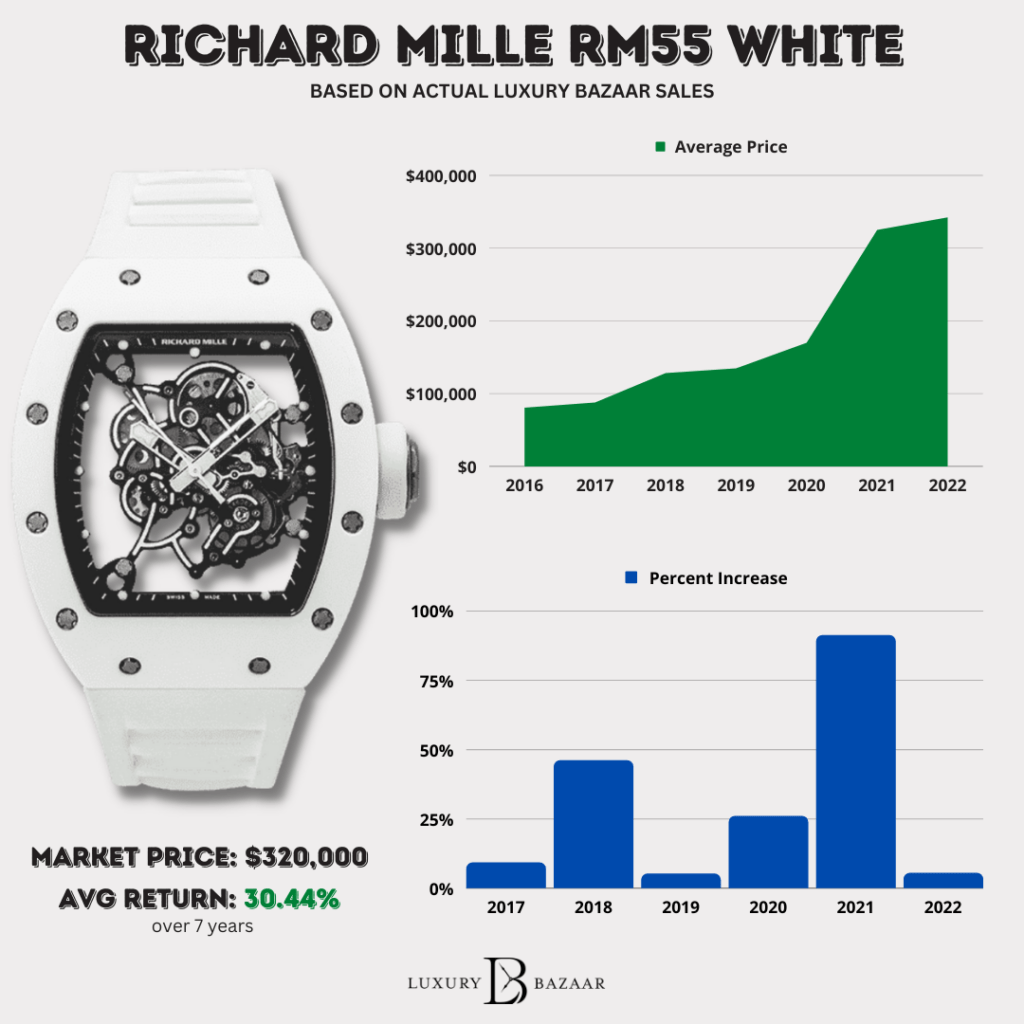

Richard Mille RM55 – White Ceramic

One of Richard Mille’s most successful partnerships was with American professional golfer Bubba Watson through the RM55 White Ceramic. When it was initially released and for many years, the RM55 in white ceramic was really a bit of a laughing stock. Many viewed it as a rich man’s white g-shock given the all-white look and it simply wasn’t a great performer for Richard Mille overall. The watch was ultra-lightweight due to the ceramic bezel and caseback of the watch and the white rubber-coated titanium mid-case.

The tech behind the watch is seriously impressive. The watch boasts the ability to resist shocks in a fashion no other watch can. There is a universal rule watch collectors should follow and that is to never wear a watch while golfing. The shocks and bumps of the golf course will cause serious harm to a wristwatch movement’s fine components. Richard Mille being the innovative brand it is, sought to find a solution to this and ultimately created a movement resistant to the shocks inherent in golf.

To achieve this, Richard Mille enlisted the help of Renaud & Papi which created an ultra-lightweight movement weighing only 4.3 grams that is suspended by 4 shock absorbers which redirect shocks to the watch’s external framework. The movement also features 2 barrels placed in parallel to ensure maximum timekeeping efficiency through reduced torque and extending the power reserve of the watch which is 55 hours.

A testament to Richard Mille’s dedication to innovation, a watch like this had never been seen or done before. This was truly a groundbreaking movement that required an incredible amount of R&D. In order to push this watch and give it the proper marketing it deserved, the watch was launched in collaboration with Bubba Watson who went on to win the Masters, golf’s most prestigious tournament, with an RM55 in white ceramic on his wrist.

Considering this was an industry first for a mechanical wristwatch and considering the incredible marketing this watch was able to receive, one would expect this Richard Mille to be wildly popular and sell well above retail prices. However, this simply wasn’t the case.

Historical Price Chart

| Year | Average Price | Percent Increase |

|---|---|---|

| 2016 | $80,667 | – |

| 2017 | $88,000 | 9.09% |

| 2018 | $128,500 | 46.02% |

| 2019 | $135,000 | 5.06% |

| 2020 | $170,000 | 25.93% |

| 2021 | $325,000 | 91.18% |

| 2022 | $342,500 | 5.38% |

In 2016, the Richard Mille RM55 white ceramic carried an average market price of approximately $80,000 which at the time was actually below its MSRP. However, this was a quick gainer and one that came a long way in a very short period. In 2017, it achieved an average market price of approximately $88,000 and exploded in value in 2018 achieving an average market price of approximately $129,000. These huge price increases coincided with the beginning stages of the social media growth Richard Mille would strongly benefit from. This also coincided with Luxury Bazaar and the general market’s top performing year for Richard Mille watches in terms of overall sales volume.

In 2019, prices stabilized to an average market price of approximately $135,000 in a similar fashion that they did for the RM10 in titanium given the overall price turbulence of bitcoin at the time – RM prices trading very much like that of the bitcoin market. However, despite the unstable bitcoin market in 2020, the price of RM55 exploded to an average market price of approximately $170,000 and rocketed even further in 2021 to an average market price of approximately $325,000. These kind of price jumps really showcase just how popular the RM55 White Ceramic Bubba Watson has become and is a testament to how far the Richard Mille market came in such a short period considering this watch traded for $80,000 in 2016.

In 2022 prices grew further to an average market price of approximately $342,000 and have now stabilized around the $320,000 range in the current market. This is another remarkable gainer from Richard Mille that came a long way from being what can only be called a laughing stock – literally thought of and nicknamed as an overpriced G-Shock – to being one of the most beloved watches from Richard Mille on the market today.

Investment Return

Despite the overall dip in the market, the Richard Mille RM55 white ceramic still experienced an average annual return of approximately 30.5% over 7 years. However, what this graph most importantly showcases is that in any given year, a watch may be subject to price fluctuations, but over time it has a proven track record of steady growth – not unlike that of the stock market. So not only do you get to wear a badass watch that has been spotted on the wrist of some of the biggest celebrities in the world, but also get a watch that has proven to be quite a lucrative alternative asset.

| Case Diameter: | 49.90mm x 42.70mm |

| Case Thickness: | 13mm |

| Case Metal: | ATZ Ceramic Bezel and caseback, white rubber coated titanium mid-case |

| Bracelet Metal: | White Rubber |

| Dial: | Skeletonized dial with white gold lume-filled applied hour plots and hour, minute and seconds hands |

| Movement: | RMUL2 – In-house developed by Renaud & Papi with groundbreaking shock absorption system – 24 jewels |

| Power Reserve: | 55 hours |

| Complications: | Hours, minutes, seconds |

| Price: | $120,000 |

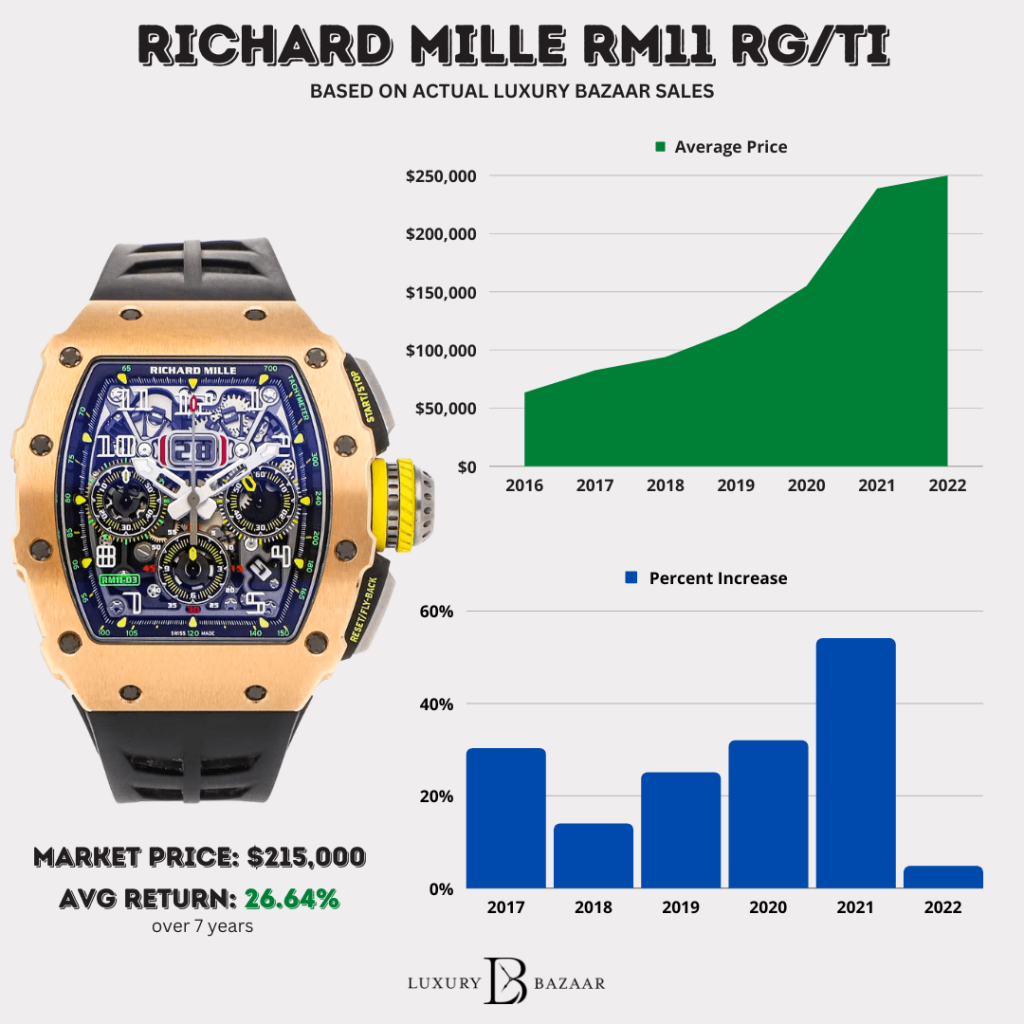

Richard Mille RM11-03 – Rose Gold & Titanium

When it comes to standard bearers and flagship models for the Richard Mille brand, the watch that carried the mantle for many years was the RM11-03. It was the gold standard chronograph model until Richard Mille launched the RM72-01, the first in-house chronograph from the brand. The watch showcased the aesthetic of Richard Mille and the racing inspiration of their watches. It was also used as a model in numerous incredibly successful collaborations, including with McClaren and Jean Todt.

The RM11-03 is a beast of a watch and a true personification of a racing machine on the wrist. The watch has a very sporty appearance given its semi-skeletonized dial which simply adds to the racing aesthetic of the watch. This aesthetic is continued further on the watch’s movement which can be displayed through the watch’s display caseback. The bridges are semi-skeletonized and as is the rotor.

The watch has a very solidly built chronograph that has added flyback functionality perfect for timing intervals on a race track. It also features a double disc big date for increased legibility. The movement powering the watch is a highly modified Vaucher caliber which boasts a power reserve of 55 hours.

Historical Price Chart

| Year | Average Price | Percent Increase |

|---|---|---|

| 2016 | $63,333 | – |

| 2017 | $82,500 | 30.26% |

| 2018 | $94,000 | 13.94% |

| 2019 | $117,500 | 25.00% |

| 2020 | $155,000 | 31.91% |

| 2021 | $238,750 | 54.03% |

| 2022 | $250,000 | 4.71% |

The RM11-03 RG Ti is another example of incredible price increases for Richard Mille. However, like nearly all earlier Richard Mille models it was originally overlooked. In 2016, the RM11-03 RG Ti carried an average market price of approximately $63,000. That’s astonishing considering current market prices sits around the $215,000 mark for this Richard Mille. The price took off in 2017 achieving an average market price of approximately $83,000. In 2018 however, the price of the RM11-03 RG Ti did not experience the same kind of push other RM models did. Adrian mentioned an important point which was around this time, Richard Mille clients had a strong shift in consumer preferences towards RM’s alternative case materials. Richard Mille really started pushing watches with their carbon TPT and NTPT materials which took off around this time and resulted in precious and semi-precious metal watches to lag behind in terms of annualized price gains.

Despite the overall turbulence of the bitcoin market in 2019 and 2020 which affected the growth of many Richard Mille models on the secondary market, prices for the RM11-03 RG Ti remained fairly stable, achieving an average market price of approximately $118,000 and $155,000 respectively. This insane growth continued into 2021 where the average market price of the RM11-03 climbed to $240,000 and grew slightly more in 2022 to about the $250,000 mark. The current market price of the RM11-03 RG Ti sits at about $215,000 which is still incredible considering how far this watch has come in only a few short years.

Investment Return

Despite the overall dip in the market, the Richard Mille RM11-03 RG Ti still experienced an average annual return of approximately 26% over 7 years. However, what this graph most importantly showcases is that in any given year, a watch may be subject to price fluctuations, but over time it has a proven track record of steady growth – not unlike that of the stock market. So not only do you get to wear a badass watch that has been spotted on the wrist of some of the biggest celebrities in the world, but also get a watch that has proven to be quite a lucrative alternative asset.

| Case Diameter: | 44.50mm x 49.94mm |

| Case Thickness: | 16.15 mm |

| Case Metal: | Rose Gold bezel and caseback, titanium midcase |

| Bracelet Metal: | Black Rubber |

| Dial: | Semi-Skeletonized dial with white gold lume-filled applied hour plots and hour, minute and seconds hands |

| Movement: | RMAC3 – Modified Vaucher Caliber – 68 jewels |

| Power Reserve: | 55 hours |

| Complications: | Hours, minutes, subsidiary seconds, chronograph seconds, flyback chronograph, double disc date display, 60-minute countdown timer, and oversized date display. |

| Price: | $160,000 |

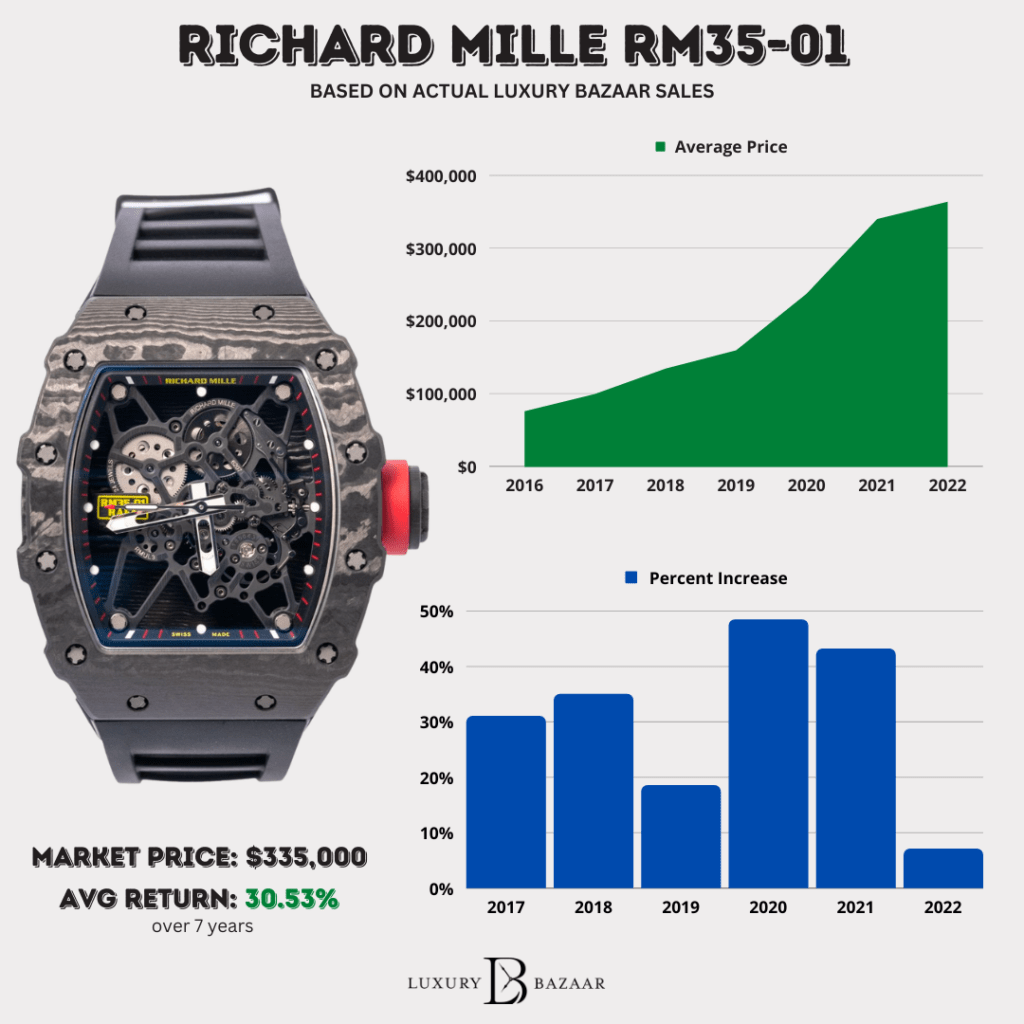

Richard Mille RM35-01 – Baby Nadal

Possibly the most successful and most followed collaborations from Richard Mille are the watches made in collaboration with Rafael Nadal. While Rafael Nadal watches are probably best known in the RM27 series, another extremely popular Rafael Nadal collaboration done for Rafael Nadal is the RM35 series. Specifically, the RM35-01 was launched as a counterpart to the RM27 series that featured the same groundbreaking technology collectors have come to expect from the brand without the added complications that make the retail price much higher. Hence the RM35-01 was nicknamed the Baby Nadal for this reason.

Related: Rafael Nadal’s $525k Richard Mille RM027 Watch Stolen Again!

The RM35-01 is extremely similar to the RM55 Bubba Watson. It features the same case proportions but the RM35-01 is cased in Richard Mille’s proprietary NTPT Carbon. These are pressed heated layers of carbon that are pressed together and later cooled until they solidify. Carbon cases are very practical as they are extremely lightweight and more resistant to scratches and signs of wear and tear. For context, carbon is five times lighter while also being five times stronger than steel for example.

Richard Mille has been a pioneer in the use of alternative materials both in terms of their cases and in terms of their movements. Carbon is the most frequently used material by RM and watches cased in carbon have become the most collectible from the Richard Mille brand apart from their exceptionally rare sapphire-cased models. This is incredibly surprising especially since it seems the less precious metal Richard Mille watches have the more valuable they are which is totally outside of the norm.

The movement powering the watch is also similar to the RM55, a slightly modified caliber powering the watch called the RMUL3 but in terms of functionality, it is really the same. The main distinction is the fact the RM35-01 has a solid caseback whereas the RM55 has a display caseback. Otherwise, the watches wear nearly identically and share the same functions.

Historical Price Chart

| Year | Average Price | Percent Increase |

|---|---|---|

| 2016 | $76,333 | – |

| 2017 | $100,000 | 31.00% |

| 2018 | $135,000 | 35.00% |

| 2019 | $160,000 | 18.52% |

| 2020 | $237,500 | 48.44% |

| 2021 | $340,000 | 43.16% |

| 2022 | $364,000 | 7.06% |

In terms of Richard Mille Baby Nadal prices, the RM35-01 was a watch that always had a decent amount of popularity although it initially traded below its retail price. However, around the 2017-2018 mark is when prices really started to take off. This was due to a combination of factors including social media hype, crypto, and more specifically bitcoin starting to really take off but also a huge surge in popularity for alternative material RM models.

In 2016, the RM35-01 Baby Nadal carried an average market price of approximately $76,000. In 2017, prices for the RM35-01 surged to an average market price of approximately $100,000 and further climbed to an average market price of approximately $135,000 in 2018. This represented back to back years of 30%+ price growth for the RM35-01 and was also witnessed in many other Richard Mille models cased in alternative materials.

In 2019 we saw many models stabilize and witness very little growth due to the price turbulence of bitcoin, but the RM35-01 remained unaffected for the most part growing by nearly 20% in value to an average market price of approximately $160,000. In 2020 with the pandemic and shaky economy, one would expect prices to have flatlined, but instead they exploded. The average market price of the RM35-01 in 2020 totaled $238,000 representing a near 50% growth in price from the previous year. This trend continued in 2021 where the price of the RM35-01 surged further to an average market price of approximately $340,000.

In 2022, growth slowed overall where the RM 35-01 has achieved an average market price of approximately $364,000. The current market price of this watch is approximately $335,000. The price explosion of this watch really can’t be understated considering this was a watch in 2016 that was trading around the $76,000 mark. It truly insane how quickly these climbed and how well they have held their value overall.

Investment Return

Despite the overall dip in the market, the Richard Mille RM35-01 Baby Nadal still experienced an average annual return of approximately 30.5% over 7 years. However, what this graph most importantly showcases is that in any given year, a Richard Mille may be subject to fluctuation in prices, but over time it has a proven track record of steady growth – not unlike that of the stock market. So not only do you get to wear a badass watch that has been spotted on the wrist of some of the biggest celebrities in the world, but also get a watch that has proven to be quite a lucrative alternative asset.

| Case Diameter: | 49.90mm x 42.70mm |

| Case Thickness: | 14mm |

| Case Metal: | Proprietary NTPT Black Carbon |

| Bracelet Metal: | Black Rubber |

| Dial: | Skeletonized dial with white gold lume-filled applied hour plots and hour, minute and seconds hands |

| Movement: | RMUL3 – In-house developed by Renaud & Papi with groundbreaking shock absorption system – 24 jewels |

| Power Reserve: | 55 hours |

| Complications: | Hours, minutes, seconds |

| Price: | $120,000 |

Takeaways

Overall, the goal of this article is not to promote watches as investments but rather to showcase that the whole narrative surrounding the “watch market crash” is really not based on reality. Just like stocks or really any other asset, watch prices may be subject to cyclical price fluctuations. However, I believe this article shows that over a longer period of time with more data points and basing ourselves on actual sale prices of these models, watch prices trade in cyclical flows, not unlike other assets, and the so-called “watch market crash” is nothing more than a cyclical price correction.

Over the last 6-7 years, whether you like it or not, watches have been proven to be a potentially lucrative alternative asset that in some cases outperforms the S&P500. But, as always, here at Luxury Bazaar we would always caution you against the notion of investing in watches and instead opt to buy what you like. In the long run, whether your watch goes up or down in value will be irrelevant because you will actually get to enjoy your watches and wear what you like without worrying about their future value.

Important Note: Please note that this article is strictly meant to be informational and for entertainment purposes only. We are not financial advisors and are not providing financial advice or suggesting you should invest in watches but rather seek to share our watch market knowledge that Luxury Bazaar has accumulated from buying, selling, and trading luxury watches over the last 20 years.

More Richard Mille Content from Grey Market:

How I LOST $100,000 on this Richard Mille Watch!

How to Avoid Buying a Fake Richard Mille Watch

Yohan Blake wore new $500k Richard Mille Watch during Olympic 100m Dash